Microfinance Global Market 2024 To Reach $330.98 Billion By 2028 At Rate Of 11.3%

Microfinance Global Market Report 2024 – Market Size, Trends, And Forecast 2024-2033

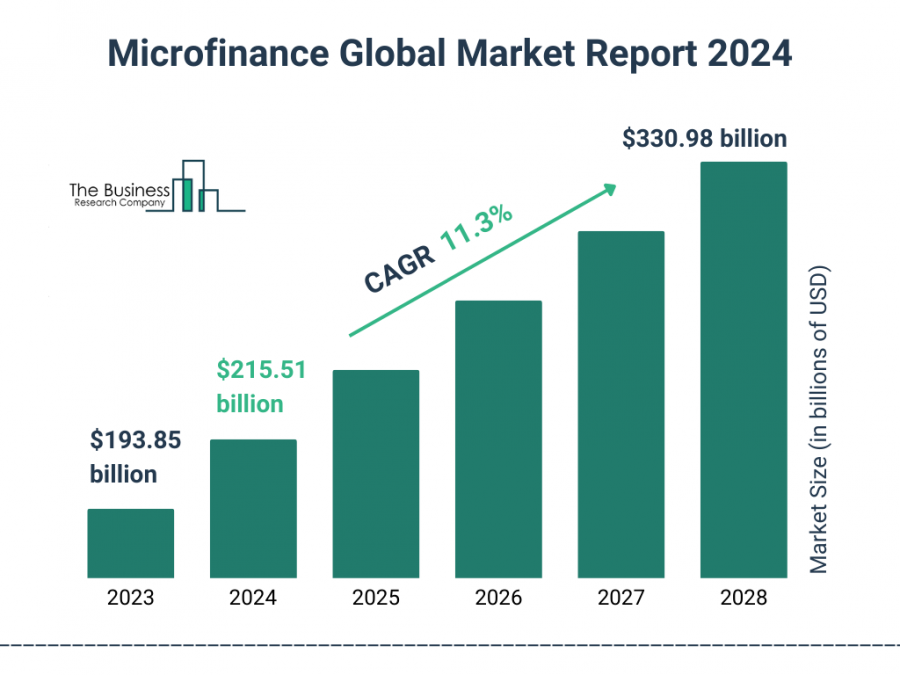

LONDON, GREATER LONDON, UNITED KINGDOM, October 10, 2024 /EINPresswire.com/ -- The microfinance market has expanded rapidly, from $193.85 billion in 2023 to $215.51 billion in 2024, with a CAGR of 11.2%. Key growth drivers include the increasing use of digital technology, commercialization and sustainability efforts, a focus on response lending, improved access to loan facilities, and greater adoption of online lending platforms.

What Is The Estimated Market Size Of The Global Microfinance Market And Its Annual Growth Rate?

The market size is projected to grow to $330.98 billion by 2028, at a CAGR of 11.3%, driven by evolving regulatory frameworks, sustainability focus, and increasing financial inclusion. Trends include cloud computing, digital identity, and embedded payments.

Explore Comprehensive Insights Into The Global Microfinance Market With A Detailed Sample Report:

https://www.thebusinessresearchcompany.com/sample.aspx?id=18671&type=smp

Growth Driver of The Microfinance Market

The increasing number of small and medium-sized enterprises (SMEs) is expected to contribute to the growth of the microfinance market moving forward. SMEs are characterized by their smaller scale in terms of revenue, assets, and employee count. The rise in the number of SMEs is driven by a surge in entrepreneurship, technological advancements lowering entry barriers, supportive government policies, and expanded access to global markets. Microfinance plays a critical role in supporting SMEs by providing access to small loans and financial services, helping them manage capital acquisition, cash flow, and risks.

Explore The Report Store To Make A Direct Purchase Of The Report:

https://www.thebusinessresearchcompany.com/report/microfinance-global-market-report

Which Market Players Are Driving The Microfinance Market Growth?

Major companies operating in the microfinance market are Bank Rakyat Indonesia (BRI), Oliver Wyman Group, Bandhan Bank Limited, LendingClub Corporation, ASA International Group PLC, Accion International, Annapurna Finance Private Limited, PRASAC Microfinance Institution Ltd., Prosper Marketplace Inc, Madura Microfinance Ltd. , Compartamos Banco, Pro Mujer International, Oikocredit International, Ujjivan Financial Services , Fundación Génesis Empresarial (FGE), Kiva Microfunds, Gojo & Company Inc., FINCA International, Fonkoze Financial Services S.A., Cashpor Micro Credit, Opportunity International, BSS Microfinance Limited, Asirvad Microfinance Limited

What Are The Emerging Trends Shaping The Microfinance Market Size?

The microfinance market is prioritizing the development of digital microfinance platforms, which enhance accessibility and streamline operations to improve financial inclusion for underserved populations. These online or mobile-based systems provide essential financial services, including microloans and savings accounts.

How Is The Global Microfinance Market Segmented?

1) By Service Type: Group And Individual Micro Credit, Leasing, Micro Investment Funds, Insurance, Savings And Checking Accounts, Other Service Types

2) By Providers: Banks, Micro Finance Institutions (MFI), NBFC (Non-Banking Financial Institutions), Other Provider

3) By Purpose: Agriculture, Manufacturing Or Production, Trade And Services, Household, Other Purposes

4) By End-Users: Small Enterprises, Micro Enterprises, Solo Entrepreneurs Or Self-Employed

Geographical Insights: Asia-Pacific Leading The Microfinance Market

Asia-Pacific was the largest region in the microfinance market in 2023, and is expected to be the fastest-growing region in the forecast period. The regions covered in the microfinance market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

Microfinance Market Definition

Microfinance offers financial services such as small loans and savings to individuals and small businesses lacking access to traditional banking. Targeted primarily at low-income populations, microfinance enables financial inclusion by providing essential financial products without the need for collateral or extensive credit histories.

Microfinance Global Market Report 2024 from The Business Research Company covers the following information:

• Market size data for the forecast period: Historical and Future

• Macroeconomic factors affecting the market in the short and long run

• Analysis of the macro and micro economic factors that have affected the market in the past five years

• Market analysis by region: Asia-Pacific, China, Western Europe, Eastern Europe, North America, USA, South America, Middle East and Africa.

• Market analysis by countries: Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA.

An overview of the global microfinance market report covering trends, opportunities, strategies, and more

The Microfinance Global Market Report 2024 by The Business Research Company is the most comprehensive report that provides insights on microfinance market size, drivers and trends, microfinance market major players, competitors' revenues, market positioning, and market growth across geographies. The market report helps you gain in-depth insights into opportunities and strategies. Companies can leverage the data in the report and tap into segments with the highest growth potential.

Browse Through More Similar Reports By The Business Research Company:

Automotive Finance Global Market Report 2024

https://www.thebusinessresearchcompany.com/report/automotive-finance-global-market-report

Auto Finance Global Market Report 2024

https://www.thebusinessresearchcompany.com/report/auto-finance-global-market-report

NLP in Finance Global Market Report 2024

https://www.thebusinessresearchcompany.com/report/nlp-in-finance-global-market-report

What Does the Business Research Company Do?

The Business Research Company publishes over 15,000 reports across 27 industries and 60+ geographies. Our research is powered by 1,500,000 datasets, extensive secondary research, and exclusive insights from interviews with industry leaders. We provide continuous and custom research services, offering a range of specialized packages tailored to your needs, including a Market Entry Research Package, Competitor Tracking Package, Supplier & Distributor Package, and much more.

Our flagship product, the Global Market Model is a premier market intelligence platform delivering comprehensive and updated forecasts to support informed decision-making.

Oliver Guirdham

The Business Research Company

+44 20 7193 0708

info@tbrc.info

Visit us on social media:

Facebook

X

LinkedIn

Distribution channels: Banking, Finance & Investment Industry, Insurance Industry, International Organizations, World & Regional

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release